BCA was first founded on 21 February 1957 as Bank Central Asia NV. The Group's principal activities are providing general banking services and other related financial services. The Group offers savings products such as savings accounts, electronic banking, credit cards, consumer credit products, banc assurance, investment products, collection, safe deposit facilities and remittance. The Group also offers foreign exchange transactions such as spot, forward and swap as well as import-export facilities such as letter of credit, bankers acceptance, bills discounting and documentary collections. Other services include safe deposit box, clearing and collection, inward/outward transfer and travelers' cheque

Sunday, February 28, 2010

ANALYSIS

·

Changes of stock rate graph

Changes of IHSG rate Graph

The Changes of LQ45 Graph

Composite Stock Price Index (JCI) or the composite share price index to use all of the shares listed as a component of the index counters. JCI reflects the overall market growth. JCI changes significantly influenced by the growth or stock price changes have a large capitalization value or it can be said is influenced by established companies. Changes in price with small capitalization almost no effect on the movement of JCI.

The policy is the Government of Indonesia to inject liquidity into the system and to maintaining macroeconomic stability has an impact positively on the national economy in 2008. PDB growth in 2008 was recorded at 6.1%, only slightly below the estimates and the expected PDB in 2009 is still experiencing growth positive. Some parties predict that Indonesia could become a country with a growth. In the first three quarters of 2008, the Bank Indonesia raised interest rates in phases to help control and inflation stabilize the rupiah. At the end of the year, Bank Indonesia began lowering interest rates gradually decrease as the price energy sector.

In line with that BCA has make adjustments to interest rates and try to ensure as far as possible interest rate offered still stable enough for depositors and debtor. Which may be a bigger problem than slowdown in the world financial sector is contracting international trade in 2008, primarily in a commodity market and export markets for products processed from Indonesia. After moving up to reach record highs in 2008, commodity prices decreased to a level range price of two or three years earlier and demand the overall market declined sharply as seen with the developments that occurred at the end of the year 2008. Indonesian economy not is immediately or fully affected the impact of the turmoil in commodity markets and we believe in the restoration of liquidity conditions and trust business, the growth cycle will return moving normally. In the middle of the current economic downturn, there are many export-oriented industries in Indonesia are quite tough to survive with the demand high enough from the domestic market. With optimize the main capabilities and focus BCA the core sectors, we are optimistic BCA will be continue to maintain the profit, and ready to move to exploit growth opportunities at the global economy recovered.

In the year 2008, there was a decline in stock values marked by the closing price of Rp2025.00 on 28th October 2008 with a value of -0.0795 declines. Based on the news that happened at that time, the global financial market conditions that occur when it has triggered economic conditions that do not support the market price of natural effects and potential systemic. Composite Stock Price Index in Indonesia Stock Exchange experienced a significant decline, which causes the termination of stock trading on the exchange by the Exchange Authority. On the other hand, deterioration of BCA is also influenced by the Farallon BCA sell stocks to cover losses. Farallon off its shares in BCA 65% higher or at Rp3.425 price-purchase price compared to 3650 in 2002 for Rp2.200 per share. On Thursday (25 / 6) and, Farallon has sold 986 million shares of BCA for Rp3.425-3.460/stock. The discount value is 9.5% of the previous closing Rp3.825/stock. 3.9% of sales value shares BBCA-coded stock is mentioned can reach Rp3, 4 trillion (U.S. $ 332 million). According to Pahlavi, by selling 3.9% stake, the Farallon ownership in BCA reduced from 51.15% to 47.2%.

Even in the year 2008 experienced a very large decline, in the same year also experienced a significant improvement. In the midst of the financial sector turmoil, BCA seeks to maintain a positive financial performance for the interests of shareholders, depositors, borrowers and employees BCA. Finally in the year 2008 was a year of success for the BCA. In the year earnings per share (EPS) reached USD 236, an increase of USD 53 compared to the previous year, while return on equity (ROE) grew from 26.7% in 2007 to 30.2% in 2008. Rate of return on assets (ROA) also recorded improved from 3.3% in 2007 to 3.4% in 2008. These results are supported by loan growth of 36.9% to Rp 112.8 trillion, higher than the initial target has been determined. In the end, net profit increased by causing equity 13.9% to Rp 23.3 trillion. Thanks to a conservative credit policy, credit quality remained awake with the level of problem loans (NPLs) in the year 2008 about 0.6% of total loans. The credit is focused on developing business borrowers, especially companies that are experts in their field and have been a customer long enough BCA.

Conclusion

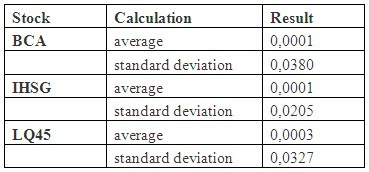

IHSG shows the market activity for stocks that are traded on stock exchanges. However, shares of BCA unaffected. IHSG is an indicator of market return. There are times when IHSG shares move up, but it has decreased BCA. Or conversely, BCA shares through an increase as IHSG move down. BCA stock return activities instead influenced internal effects, such as the sale of shares. Therefore, investors who want to buy and sell shares in BCA do not have to pay attention to returns and risks in the market place. In addition, stock returns are often caused by the stock price is very expensive BCA making investors reluctant to buy shares in BCA and choose to invest in other companies. With the lack of transactions is not influenced by price changes in supply and purchase transactions of shares.

Saturday, January 30, 2010

"thE meaNing of OuR grOup"

Definition 1

Definition 2

thE yieLd of A fixeD inComE seCuritY.

Definition 3

saMe as TaX retUrn.

(investorword.com)

GrouP memBers prOfile

1. ineZ adElaiDa

niCk nAme: ineZ

daTe of biRth: deceMber 11, 1989

relogiOn: islAm

inforMation abOut mE:

hi all, my nAme inEz AdelAide but yOu cAn caLl me iNez. I wAs the fiRst cHild, I alSo haVe a yoUngEr broTherR who is vEry deAr to me. I am now stUdyiNg at University Atmajaya Yogyakarta. I majored in ecoNomics manAgemEnt. I reAlly liKed the bOok that teLls of the romAnce oUt of love is very romAntic aNd I speNd a lot to gEt somEthing frOm the bOok.

2. i GusTi agUng agUs surYa dHarma

nicK namE: agunG

daTe of BirTh: march 7, 1990

reliGioN: hinduiSm

informaTion abOut mE:

wow, tHis is my fiRst bLog, ok i woUld likE to intrOduce my Self,my name is i GusTi aGunG aGus SurYa dHarma, you can caLl me aGunG, try to see my naMe, mUst be very stRaNge in your heAriNg. indeEd, I coMe frOm BaLi. Bali is a paRadiSe vacAtion. I was in 4th semeSter and I majOred in ecoNomics manageMent. I am a noMads, so I am very hAppy if YoU be my fRienD, hahahaha

3. aUditiA setIobuDi

nicK name: audiTia

datE of biRth: januarY 25, 1990

religiOn: catholic

infoRmation aboUt me:

yuhui, aUdiYia setiObuDi my nAme, yoU can cAll me auDiTia, hihihihihihi... I wAs 19 yeArs oLd. I was in 4th semEsTer. My hobby is sleEping and go arouNd thE streeTs. I love looKing iNto a remOte area tHat I had neVer visiTed let alOne with my frieNds. I really like people who judge me what it is like my frieNds who always carEd for me. if your frieNds waNt to knOw me, I would be very haPpy if my friends the otHer to be my friend, Ok